Business Setup in India: How Business Setup Consultants Can Simplify Your Journey

India has emerged as one of the most attractive destinations for entrepreneurs and investors looking to establish new businesses. With a rapidly growing economy, supportive government initiatives, and a thriving market, the opportunities for business setup in India are immense. However, navigating the legal, regulatory, and procedural requirements can be challenging, making professional guidance essential. This is where business setup consultants in India play a crucial role, offering end-to-end support to ensure a smooth and compliant business launch.

Understanding Business Setup in India

Business setup in India refers to the entire process of establishing a legal and operational entity in the country. This involves selecting the appropriate business structure, registering the company with regulatory authorities, obtaining necessary licenses and permits, and ensuring compliance with local and national laws. Businesses can choose from multiple forms of registration, including private limited companies, public limited companies, one-person companies, limited liability partnerships (LLPs), and proprietorships, depending on their goals and scale of operations.

The process of business setup in India involves several key steps: obtaining a company name approval, preparing incorporation documents, registering with the Ministry of Corporate Affairs (MCA), and securing tax registrations such as GST, PAN, and TAN. While the process may seem straightforward, it often involves complex legal, regulatory, and documentation requirements that can overwhelm first-time entrepreneurs.

Why You Need Business Setup Consultants in India

Business setup consultants in India provide specialized expertise to help entrepreneurs navigate the complexities of starting a business. They act as strategic partners, guiding clients through every step of the incorporation and setup process. Their services typically include:

-

Advising on the most suitable business structure based on the nature of operations and long-term goals.

-

Assisting with name approval and registration processes.

-

Preparing and filing incorporation documents with the relevant authorities.

-

Obtaining necessary licenses, permits, and registrations.

-

Offering guidance on compliance with statutory requirements and tax regulations.

By partnering with experienced consultants, entrepreneurs can save time, avoid costly mistakes, and focus on their core business activities rather than administrative hurdles.

Benefits of Engaging Business Setup Consultants in India

-

Expert Guidance: Business setup consultants in India bring in-depth knowledge of regulatory frameworks, legal requirements, and industry practices, ensuring your business is set up correctly from the start.

-

Time Efficiency: With their expertise, consultants streamline the setup process, reducing delays caused by paperwork, approvals, and compliance formalities.

-

Cost Savings: Avoiding errors in registration and compliance can prevent penalties and additional expenses, making professional guidance a cost-effective investment.

-

Tailored Solutions: Consultants assess the unique needs of each business and recommend solutions that align with growth plans, operational requirements, and market strategies.

-

Post-Setup Support: Many consultants offer ongoing services, including annual compliance, accounting support, and legal assistance, ensuring that the business remains in good standing with authorities.

Steps Involved in Business Setup in India

-

Choosing the Business Structure: Selecting the right type of company—be it a private limited company, LLP, or proprietorship—is crucial for taxation, liability, and operational flexibility.

-

Company Name Approval: Entrepreneurs must propose a unique business name and secure approval from the Registrar of Companies (RoC) to comply with naming regulations.

-

Document Preparation and Filing: Key documents, such as the Memorandum of Association (MoA), Articles of Association (AoA), and director/shareholder declarations, are prepared and filed with the Ministry of Corporate Affairs.

-

Obtaining Licenses and Registrations: Businesses must secure licenses relevant to their industry, including GST registration, PAN, TAN, and other sector-specific approvals.

-

Post-Incorporation Compliance: Once the business is set up, regular compliance with statutory filings, tax obligations, and corporate governance is mandatory to avoid penalties.

Choosing the Right Business Setup Consultant in India

Selecting the right consultant is vital to ensure a smooth business setup experience. Key factors to consider include:

-

Proven experience in company registration and business advisory services.

-

Knowledge of sector-specific regulations and compliance requirements.

-

Positive client testimonials and successful track record.

-

Ability to offer end-to-end solutions, from incorporation to post-setup compliance.

-

Transparent pricing and clear communication.

A competent business setup consultant can make the difference between a seamless setup process and one fraught with delays and compliance issues.

Conclusion

Business setup in India offers significant opportunities for growth, innovation, and market expansion. However, the complexities of legal procedures, documentation, and regulatory compliance can pose challenges for entrepreneurs. By engaging professional business setup consultants in India, businesses can ensure a smooth, efficient, and legally compliant launch.

From choosing the right company structure to obtaining licenses and handling post-incorporation compliance, consultants provide valuable support at every step. Investing in expert guidance not only saves time and reduces risks but also lays the foundation for sustainable business growth in India’s dynamic and competitive market.

For entrepreneurs looking to establish a successful presence, partnering with trusted business setup consultants in India is a strategic decision that enables them to focus on innovation, expansion, and long-term success.

- Share

YOU MIGHT ALSO ENJOY

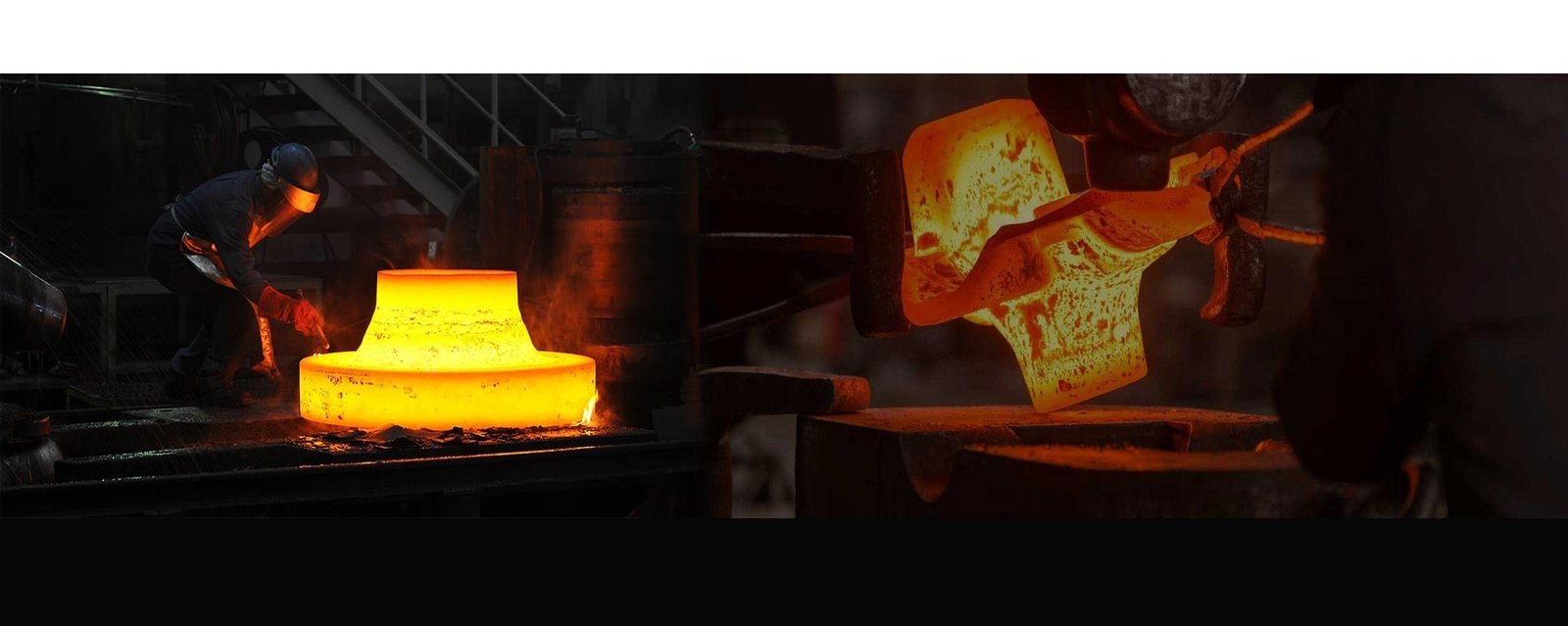

Small Parts, Big Strength: How Forged Fittings Keep Industrial Systems Alive

Stephen Romero - February 10, 2026

How India Quietly Became the Backbone of the World’s Piping and Flange Needs

Stephen Romero - February 10, 2026

Why There Is No Future Without Stainless Steel for an Eco-Friendly Environment

Stephen Romero - February 10, 2026

search

FAST ACCESS

- art&gallery (4)

- Automotive (25)

- beauty (7)

- blog (479)

- Business (814)

- cleening (13)

- clinic (1)

- courier services (4)

- dentel care (6)

- Driving school (3)

- electronics (1)

- events (1)

- food (1)

- forests (11)

- gameing (5)

- Health (29)

- Health & Fitness (218)

- Home & Garden (16)

- Landscaping (1)

- Law (16)

- Lifestyle (14)

- machinery (5)

- Real Estate (9)

- Share Market (15)

- Shopping (7)

- Technology (31)

- tool (2)

- toys (2)

- Travel (43)

- Wedding & Events (338)

must read

Small Parts, Big Strength: How Forged Fittings Keep Industrial Systems Alive

Stephen Romero - February 10, 2026

How India Quietly Became the Backbone of the World’s Piping and Flange Needs

Stephen Romero - February 10, 2026

Why There Is No Future Without Stainless Steel for an Eco-Friendly Environment

Stephen Romero - February 10, 2026

Where Do Specialized Steel Pipes Fit Into Energy and Pipeline Infrastructure?

Stephen Romero - February 10, 2026

What Should Buyers Look for in a Complete Steel Materials Supplier?

Stephen Romero - February 10, 2026

recent post

ARCHIVES

- February 2026 (57)

- January 2026 (210)

- December 2025 (151)

- November 2025 (132)

- October 2025 (105)

- September 2025 (166)

- August 2025 (164)

- July 2025 (150)

- June 2025 (173)

- May 2025 (99)

- April 2025 (1)

- March 2025 (8)

- February 2025 (9)

- January 2025 (8)

- December 2024 (25)

- November 2024 (40)

- October 2024 (11)

- September 2024 (1)

- July 2024 (10)

- June 2024 (11)

- May 2024 (31)

- April 2024 (15)

- March 2024 (19)

- February 2024 (6)

- January 2024 (7)

- December 2023 (11)

- November 2023 (1)

- July 2023 (13)

- June 2023 (21)

- May 2023 (27)

- April 2023 (23)

- March 2023 (16)

- February 2023 (31)

- January 2023 (27)

- December 2022 (11)

- November 2022 (12)

- October 2022 (11)

- September 2022 (11)

- August 2022 (14)

- July 2022 (13)

- June 2022 (19)

- May 2022 (17)

- April 2022 (10)

- March 2022 (12)

- February 2022 (8)

- January 2022 (9)

- December 2021 (19)

- November 2021 (4)

- October 2021 (6)

- September 2021 (4)

- August 2021 (4)

- July 2021 (10)

- June 2021 (6)

- May 2021 (2)

- April 2021 (2)

- March 2021 (45)

- August 2020 (31)

- July 2020 (30)

- June 2020 (29)