Business Setup in India: A Complete Guide to Company Incorporation with Seraphic Advisors

Stephen Romero - January 7, 2026

- Share

YOU MIGHT ALSO ENJOY

What trends are kurti manufacturers currently focusing on?

Stephen Romero - February 21, 2026

What Services Does a Professional Aluminium Supplier Singapore Offer?

Stephen Romero - February 21, 2026

Unlock Big Savings with restaurant discount Deals and 2 for 1 restaurants Offers – Discover Smart Dining with oferta24

Stephen Romero - February 20, 2026

search

FAST ACCESS

- art&gallery (4)

- Automotive (25)

- beauty (7)

- blog (507)

- Business (850)

- cleening (13)

- clinic (1)

- courier services (4)

- dentel care (6)

- Driving school (3)

- electronics (1)

- events (1)

- food (1)

- forests (11)

- gameing (5)

- Health (30)

- Health & Fitness (218)

- Home & Garden (16)

- Landscaping (1)

- Law (16)

- Lifestyle (14)

- machinery (5)

- Real Estate (9)

- Share Market (15)

- Shopping (7)

- Technology (31)

- tool (2)

- toys (2)

- Travel (43)

- Wedding & Events (340)

must read

What Services Does a Professional Aluminium Supplier Singapore Offer?

Stephen Romero - February 21, 2026

Tytuł: Breloki reklamowe PVC i gadżety z logo firmy – skuteczna reklama, która działa każdego dnia

Stephen Romero - February 21, 2026

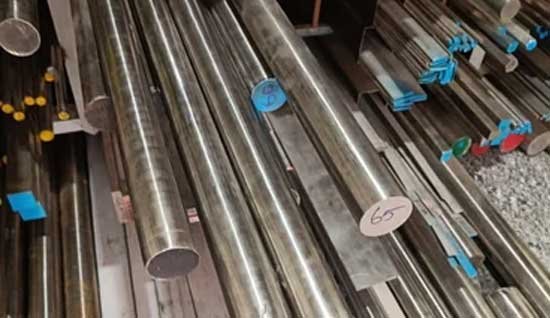

How to Choose Reliable SS Round Bar Suppliers for Industrial Needs

Stephen Romero - February 20, 2026

recent post

ARCHIVES

- February 2026 (124)

- January 2026 (210)

- December 2025 (151)

- November 2025 (132)

- October 2025 (105)

- September 2025 (166)

- August 2025 (164)

- July 2025 (150)

- June 2025 (173)

- May 2025 (99)

- April 2025 (1)

- March 2025 (8)

- February 2025 (9)

- January 2025 (8)

- December 2024 (25)

- November 2024 (40)

- October 2024 (11)

- September 2024 (1)

- July 2024 (10)

- June 2024 (11)

- May 2024 (31)

- April 2024 (15)

- March 2024 (19)

- February 2024 (6)

- January 2024 (7)

- December 2023 (11)

- November 2023 (1)

- July 2023 (13)

- June 2023 (21)

- May 2023 (27)

- April 2023 (23)

- March 2023 (16)

- February 2023 (31)

- January 2023 (27)

- December 2022 (11)

- November 2022 (12)

- October 2022 (11)

- September 2022 (11)

- August 2022 (14)

- July 2022 (13)

- June 2022 (19)

- May 2022 (17)

- April 2022 (10)

- March 2022 (12)

- February 2022 (8)

- January 2022 (9)

- December 2021 (19)

- November 2021 (4)

- October 2021 (6)

- September 2021 (4)

- August 2021 (4)

- July 2021 (10)

- June 2021 (6)

- May 2021 (2)

- April 2021 (2)

- March 2021 (45)

- August 2020 (31)

- July 2020 (30)

- June 2020 (29)